Our Resources

Cain & Daniels, Inc.

has 20+ years experience and over 10,000 cases settled since 2012, we are your business' first choice for debt settlement solutions. We created a set of resources to answer almost all of your situations.

Gain more insight about what Cain & Daniels can do for you.

Cain & Daniels, Inc. Leads the Way in Commercial Debt Settlement With Innovative Restructuring Solutions

Cain & Daniels, Inc., a leading provider of commercial debt settlement services, continues to distinguish itself in the industry with a highly specialized approach to business

What Can I Expect to Pay for Court Costs if I Settle?

Depending on the state, or country you are in court fees with vary. Regardless of the specific amount involved per state due to settling in

Bank Garnishments and Additional Interest

When you find yourself in court and being faced with a judgment, it could be just the beginning of a bigger financial mess. The court

Getting Out of Debt

Assess Your Current Debt Situation The first step to getting out of debt is to fully understand the details of what you currently owe. Grab

Business Debt Restructuring

Individuals develop debt over the years due to things like credit card balances and student loans, but this is not simply a problem for individual

Business Debt Advisors

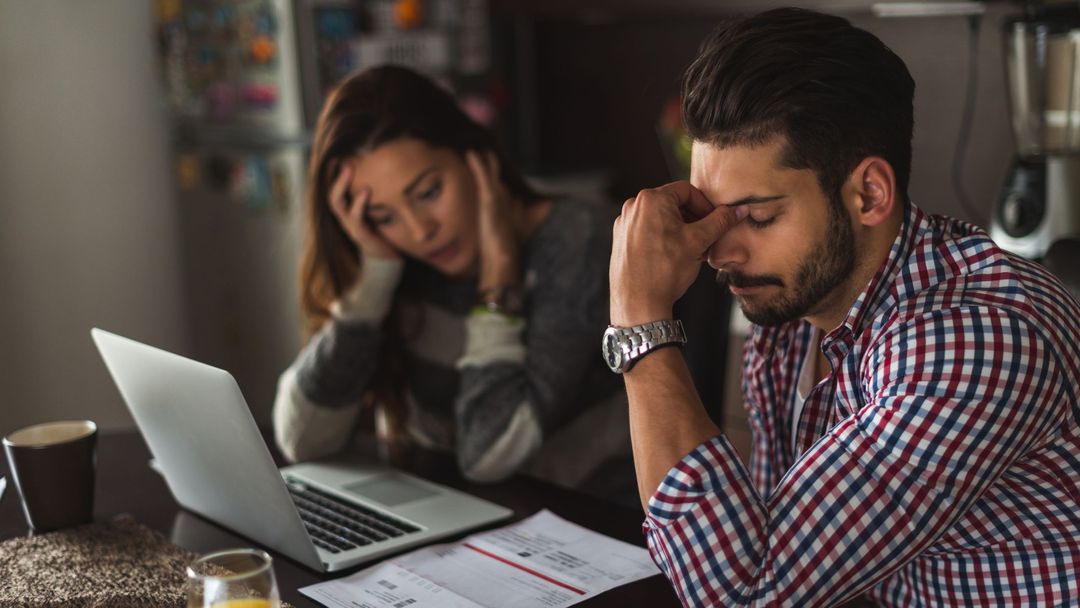

There is little disputation that debt is one of, if not the most potent financial stressors that individuals face regularly. People acquire it through a

Personal Debt

It is an unfortunate reality that many adults today have some form of debt weighing on their finances. Whether accrued through student loans in college

Business Debt Solutions

One of the best ways to find a solution to your problems with business debt is to determine how you got there in the first

Execution of Judgements

When judgments roll in, a business can suffer – or even be forced to declare bankruptcy. Cain & Daniels, Inc. can help! With over 20

Judgements

A judgment is a legal obligation to pay a debt after you have been taken to court. Judgments are legally binding contracts by the court

Past Dues

If you find yourself a few months behind on payments, these are known as past dues. If you get too behind your creditor may want

Bankruptcy Alternative

Are you considering bankruptcy as an option for your business’ future? There’s a better alternative. At Cain & Daniels, Inc. we have been helping businesses come

What Should I Do If I am Facing a Lawsuit?

If you find your business in debt and up against a lawsuit, Cain and Daniels can help you to settle out of court and get

Credit Card Debt Settlement

At Cain & Daniels, we have a wealth of experience when it comes to dealing with debt in an efficient, professional and competent way. Credit

Involuntary Insolvency: A Creditor’s Nuclear Option

What is Involuntary Insolvency? Involuntary insolvency, otherwise known as involuntary bankruptcy, is a legal process where creditors can initiate bankruptcy proceedings against a debtor without

Small Business Debt Settlement: Your Complete Roadmap

Understanding Small Business Debt If you didn’t know, small businesses take on various types of debt as part of their operations. Common debt types include

Renegotiating Business Debt: How to Secure Better Terms

Why Renegotiate Business Debt? Renegotiating business debt can provide much-needed breathing room and financial flexibility when companies face challenges. There are several key reasons to

Past Due vs. Overdue: What’s the Difference and Why It Matters

Defining Past Due The term “past due” refers to a payment or debt obligation that has not been fulfilled by the due date. Typically, an

How to Stop a Lawsuit From a Creditor: 7 Proven Tactics to Protect Yourself

How to Stop a Lawsuit From a Creditor: 7 Proven Tactics to Protect Yourself Contact us +10 Years of experience 1. Understand Your Rights and

Forced Bankruptcy by Creditors: When Creditors Pull the Trigger

What is Involuntary Bankruptcy? Involuntary bankruptcy is a legal process where forced bankruptcy by creditors is established onto the debtor through the courts, even if

Your Ultimate Guide to Business Debt Settlement Companies

What is Business Debt Settlement? Business debt settlement is a process where a company negotiates with creditors to settle outstanding debts for less than the

What is Cain & Daniels?

At Cain & Daniels, Inc., we are a business debt settlement company that holds to our motto that your business is business! We specialize in

Third Party Debt Exposed: The Secrets They Don’t Want You to Know

Cain & Daniels, Inc. have over 20 years of experience as third party representation in commercial debt settlement cases. In those 20 years, we have

Commercial Debt Settlement

When debts start to pile up and lawsuits start to roll in, your business has two options: declare bankruptcy or engage in a commercial debt

Contact Us

Speak to a Business Debt

Specialist Today

You will always know your settlement amount before you hire us to represent you.